EarnIn offers tools like Cash Out that help our community members improve their finances in the present. Now, we’re moving forward with a product focused on building a bright financial future. We’re proud to announce Tip Yourself, a savings tool¹ that will be available to the EarnIn community this month. Tip Yourself is a new, easy way to save money that turns saving from a passive and lonely task into something active and social. It encourages people to reward themselves for their achievements in a constructive way and support each other for saving money.

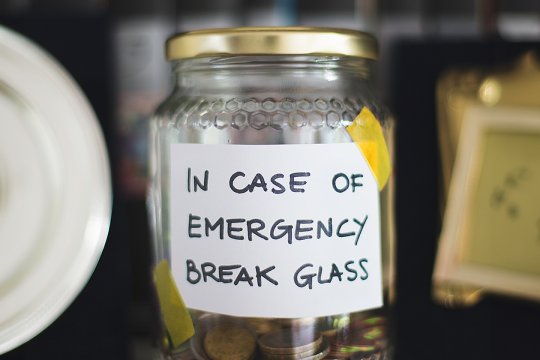

You tip others for good service or to pay it forward, but now you can tip yourself. With Tip Yourself, you can set up Tip Jars to save money for specific financial goals, like building an emergency fund or saving for a home improvement project. When you accomplish things throughout your day, whether it’s working out, finishing a project, or going to bed early, you can give yourself a tip as a reward by transferring money from your linked checking account to one of your Tip Jars. Tips are customizable and can be as low as $1, so you can set aside an amount that works for you. After you tip, you can share your reason for tipping with the rest of the EarnIn community, congratulating them while receiving support. There’s also the Pay Yourself First feature, which lets you set up a recurring tip that transfers money from your bank to a Tip Jar automatically on payday.

Once you meet your goals or have an emergency expense, you can withdraw money from your Tip Jars and transfer it back to your bank. Tip Yourself withdrawals support Lightning Speed, so you can access your savings fast.

EarnIn seeks to inspire everyone to rethink how they save. That’s why Tip Yourself lets community members set aside money in a way that’s radically different from old-fashioned saving accounts. With Tip Yourself, we want to empower our community to save more, even if it’s just a few dollars here and there, and we want them to feel supported while they do it.

With the right tools and motivation, almost anyone can save for tomorrow. You tip other people, why not tip yourself?

Please note that you need to be an EarnIn Community Member to use Tip Yourself. For more details, read the EarnIn Terms of Service. Tip Yourself is a 0% Annual Percentage Yield and $0 monthly fee service*. For more information visit https://www.earnin.com/privacyandterms#tipyourself

¹ You shouldn’t have to pay to save. Tip Yourself is a 0% Annual Percentage Yield and $0 monthly fee service. For more information visit https://www.earnin.com/privacyandterms#tipyourself

Photo by Josh Appel

You may enjoy

EarnIn is a financial technology company not a bank. Subject to your available earnings, Daily Max and Pay Period Max. EarnIn does not charge interest on Cash Outs. EarnIn does not charge hidden fees for use of its services. Restrictions and/or third party fees may apply. EarnIn services may not be available in all states. For more info visit earnin.com/TOS.